European Regulatory Roll-out Package guide

From XBRLWiki

(diff) ←Older revision | Current revision | Newer revision→ (diff)

CEN Workshop Agreement

Status: Working Group Working Draft

Editing rules

Editorial comments should be highlighted as follows: A comment

Text or rules in discussion (white): Some text

Text or rules already aligned (green): Some text

Text or rules to be deleted (red): Some text

Text to be delivered (blue): Some text

Foreword

This document is a working document.

This document has been prepared by CEN/WS XBRL, the secretariat of which is held by NEN.

This document is a working document.

Introduction

The set of recommendations included in this document aim to facilitate the implementation of European National Supervisors to adopt XBRL in any of the reporting frameworks. The following chapters will provide guidance on the use, understanding, preparation, and extension of their filings in eXtensible Business Reporting Language (XBRL).

This guidance is in the form of notes in association with the pertaining requirements clause and uses the terms “should” (recommendation), “may” (allowance) and “can” (possibility). Organizations wishing to implement this CWA would be expected to consider all recommendations where the term “should” is used.

Scope

COREP, FINREP (and Solvency II or other future) XBRL taxonomies are offered to European regulators for national implementation. The first releases (2006) of the COREP and FINREP XBRL frameworks have proven that a standardized technical roll-out package is needed to increase the adoption rate and avoid implementation variances, which have a detrimental effect on the overall cross-border effectiveness of using one reporting standard. As well this roll-out guide try to promote the economies of scale for a better adoption.

This CWA have divided the work/deliveries in two difference parts:

- i) An XBRL supervisory roll-out guide: this is oriented towards national regulators on how to implement, extend and manage XBRL taxonomies

- ii) An XBRL handbook for declarers: this is a roll-out guide or reference handbook would give a general introduction to XBRL and serve as a help to preparers of XBRL (reporting entities)

- i) An XBRL supervisory roll-out guide: this is oriented towards national regulators on how to implement, extend and manage XBRL taxonomies

The scope of the current document is the first part of the CWA; the XBRL supervisory roll-out guide. In this general guide to XBRL, the following subjects will be addressed.

The guidance and recommendations included in this document have been created for regulatory filings in the context of European supervisory reporting.

In this document, “regulatory filings” encompasses authoritative financial reporting standards and generally accepted accounting principles/practices (or GAAP), regulatory reports whose subject matter is primarily financial position and performance and related explanatory disclosures, and data sets used in the collection of financial statistics; it excludes transaction- or journal-level reporting, primarily narrative reports (for example, internal controls assessments) and non-financial quantitative reports (for example, air pollution measurements).

Normative references

Some text

The following referenced documents are indispensable for the application of this document. For dated references, only the edition cited applies. For undated references, the latest edition of the referenced document (including any amendments) applies.

EN xyz:199x, Title of the european standard.

EN ab c:199x, General title of series of parts — Part c: Title of part.

Terms and definitions

For the purposes of this document, the following terms and definitions apply:

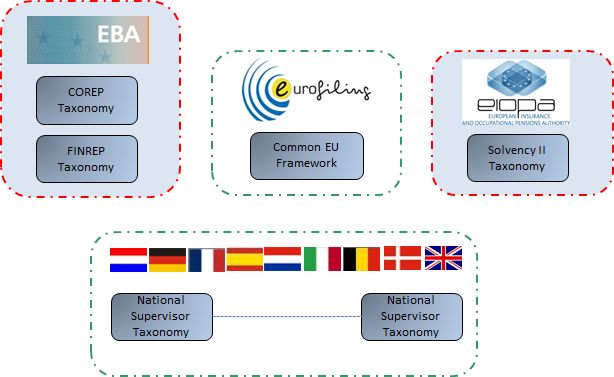

- Eurofiling

- Eurofiling project is an open joint initiative of the European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA) in in collaboration with XBRL Europe, as well as stakeholders as banks, solutions providers, academy and individuals. The deliverables are Data Models, XBRL taxonomies, know-how and materials for Supervisory Frameworks: COREP, FINREP and Solvency II.

- ESFS European System of Financial Supervisors

- Before and during the financial crisis in 2007 and 2008, the European Parliament has called for a move towards more integrated European supervision in order to ensure a true level playing field for all actors at the level of the European Union and to reflect the increasing integration of financial markets in the Union. As a result, the supervisory framework was strengthened to reduce risk and severity of future financial crises. European System of Financial Supervisors that comprises three European Supervisory Authorities, one for the banking sector (EBA), one for the securities sector (ESMA) and one for the insurance and occupational pensions sector (EIOPA), as well as the European Systemic Risk Board.

- EBA

- The European Banking Authority was established by Regulation (EC) No. 1093/2010 of the European Parliament and of the Council of 24 November 2010.

- The EBA has officially come into being as of 1 January 2011 and has taken over all existing and ongoing tasks and responsibilities from the Committee of European Banking Supervisors (CEBS).

- The EBA acts as a hub and spoke network of EU and national bodies safeguarding public values such as the stability of the financial system, the transparency of markets and financial products and the protection of depositors and investors.

- The EBA has some quite broad competences, including preventing regulatory arbitrage, guaranteeing a level playing field, strengthening international supervisory coordination, promoting supervisory convergence and providing advice to the EU institutions in the areas of banking, payments and e-money regulation as well as on issues related to corporate governance, auditing and financial reporting.

- COREP and FINREP

- To achieve a high level of harmonization and strong convergence in regular supervisory reporting requirements, EBA has been developing guidelines on supervisory reporting with the aim of setting up a supervisory reporting model with common data definitions. The Guidelines on Financial Reporting cover consolidated and sub-consolidated financial reporting for supervisory purposes based on IAS/IFRS as endorsed by the European Union.The original Guidelines on FINREP were issued by the Committee of European Banking Supervisors in December 2005. Agreed changes in IFRS were incorporated into the latest FINREP published in December 2009.

- Further major changes to the accounting standards which will impact FINREP are expected. The revised FINREP will be reviewed in due course to take account of the changes in accounting standards.

- EIOPA

- The European Insurance and Occupational Pensions Authority (EIOPA) was established in consequence of the reforms to the structure of supervision of the financial sector in the European Union. The reform was initiated by the European Commission, following the recommendations of a Committee of Wise Men, chaired by Mr. de Larosière, and supported by the European Council and Parliament.

- EIOPA’s main goals are:

- Better protecting consumers, rebuilding trust in the financial system.

- Ensuring a high, effective and consistent level of regulation and supervision taking account of the varying interests of all Member States and the different nature of financial institutions.

- Greater harmonisation and coherent application of rules for financial institutions & markets across the European Union.

- Strengthening oversight of cross-border groups.

- Promote coordinated European Union supervisory response.

- EIOPA’s core responsibilities are to support the stability of the financial system, transparency of markets and financial products as well as the protection of policyholders, pension scheme members and beneficiaries. EIOPA is commissioned to monitor and identify trends, potential risks and vulnerabilities stemming from the micro-prudential level, across borders and across sectors.

- EIOPA is an independent advisory body to the European Parliament, the Council of the European Union and the European Commission.

- SOLVENCY II

- The Solvency II Directive 2009/138/EC is an EU Directive that codifies and harmonises the EU insurance regulation. Primarily this concerns the amount of capital that EU insurance companies must hold to reduce the risk of insolvency.

- Once the Omnibus II directive is approved by the European Parliament, Solvency II will be scheduled to come into effect. [1] [2]

How to start with XBRL. Supervisory Perspective

This chapter describes how the XBRL standard can be implemented from the regulator's perspective.

First is presented the different levels of XBRL adoption, defining the supervisor's strategy.

This is followed by elaborating the minimum amount of steps needed to facilitate a proper introduction of the XBRL standard.

Then it is presented the adaptation and review of the reception infrastructures and the internal information systems that could be impacted by the use of XBRL in the reporting process.

Finally it will be described additional considerations to prepare and plan in order to establish the proper circuits and services to enable the standard with the reporting entities.

Determine the level of XBRL adoption

Since the XBRL Standard has been adopted several years ago, a different amount of alternatives on the exchange of XBRL between regulators and reporting entities have emerged.

The choice of a specific adoption strategy by the regulator is probably the first important step. The adoption strategy establishes the roadmap from the regulator's current reporting requirements towards the new rules.

Attending to the level of penetration (or permeability) of XBRL between the Regulator and the Filing entities the adoption can be classified in the following:

- Using XBRL only as the electronic format of interchange.

- Adapting software applications in reception and submission to use XBRL as well as interchange format, for example relying in the business rules for formula validation.

- Exploit for internal reporting models (multi dimensional) as well as for external reporting the XBRL standard.

According to the previous approach the regulator must also decide how many facilities in the form of XBRL enabled software application for their internal departments and for external entities is going to provide.

To mention a few examples there is a range from validation, visualization, monitoring, versioning that will facilitate the analysis and supervision of reported information.

Plan and prepare the new reporting models

On the regulator's perspective there are two main key drivers in the XBRL adoption: compliance with new regulation directives and data accuracy reported by reporting entities.

Compliance with new regulation directives implies the adequacy of the reporting business models and rules to the XBRL language and semantics to be implemented.

The most important requirement for financial supervision reporting is data accuracy. Reported data, for legal reasons, is expected to be:

- accurate for arithmetic purposes

- calculated accurately based on the required definition

- preserved during the data transfer process

It is also a good idea to plan and prepare the adaptation of all data requirements. For this, the regulator needs to obtain proper knowledge on the following topics:

- Learn the basics, how XBRL works, what is the terminology.

- How the data models have been driven from business model and semantic rules into XBRL syntactic schemas and fillers forms that define reporting data. Take into account the last architecture modeling issues that the required information is providing.

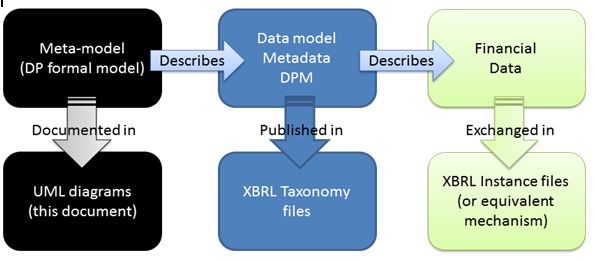

- It is specially recommended to apply a structured methodology for data modeling. On this topic the Eurofiling architecture approach is proposing a methodology on normalization called Data Point Modeling. This will be introduced later in chapter 6, but it mainly consists on defining a method to model dictionary data, their aspects and relationships in terms of domains and hierarchies, the business validation rules and the corresponding classifications of the data in different tables and forms for filing and visualization.

Figure 1: Diagram describing the DPM process and its relationship with XBRL.

- How this data inherited from the European frameworks fits into the national reporting model. Study if the current information models for reporting entities have more disclosures or information. In case more detailed information is required, knowledge on the extension of European taxonomies is needed. This will be detailed in chapter 5.

- The regulator will have to answer several questions before taking decisions that will mark their path to the reporting processes. These questions can be one of the following:

- How many different reporting templates do we need to receive from reporting entities?

- What is the frequency of this reporting information quarterly, half-yearly, yearly?

- What is the smallest reporting unit of information to receive?

- What is the maximum recommended size for each report to receive?

- What is the response time of the received reporting information?

- Is it allowed to submit partial reporting information?

- Is it allowed to re send reports or partial reports for amendments after submission?

Adapt and Review reception infrastructures

From the IT's perspective the regulators will have the opportunity to review their current transmission infrastructures with the reporting entities to incorporate the new reporting standard to their channels:

In case the regulator has well established mechanisms in place, the required activity is to adapt these circuits to interchange XBRL instance documents, including additional circuits of submission for header information and validation reports following recommendations given in document (CWA2) and they will be introduced later in chapter 8.

A set of items to review are:

- Select, reuse or adapt the transmission channel (web secure portal upload, email secure smtp, web service secure integration submission, other). This item will be further elaborated during the workshop to refer to final recommendations to be given from CWA2.

- Select, reuse or adapt the security signature and certificates to be used for reporting entities.

- Select the additional services on the submission protocol to implement (tracking or monitoring information submitted, visualization on reported instances, pre validation on regulatory requirement information, etc.)

Adapt and Review internal Information systems

For those regulators that are adopting XBRL into their internal information systems, it is required to adapt and review how to fit the received information according to XBRL semantics into their information systems. This will permit to take advantage of the standard using OLAP models, formula validation across multiple reporting documents and exploiting the information using business intelligence tools.

Currently there are few national supervisors that can set a common set of recommendations to follow to be part of this section, as each national internal system is outside the scope of harmonization topics of this document.

A clear assessment regarding internal adoption is that the European framework and the XBRL International abstract model version 2.0 provide a clear method to enable consistent definition of business information. Including rules and validations that facilitates the creation of XBRL data-warehouses to access and analyze reporting information through the different perspectives of regulatory reporting (compliance, risk, prudency, transparency).

Prepare the communication plan for Reporting Entities

Once the regulator has taken all required actions to adapt the information systems to support the interchange of reporting information using XBRL, it is required to establish a clear communication plan for reporting Entities.

This section will be further elaborated during the workshop with information and references to the Declarer’s Handbook.

Summary

During this chapter the regulatory supervisor has been able to introduce all the topics required to establish a roadmap to adapt their systems and plan the reporting information adaptations to produce.

Final conclusions will be further elaborated during the workshop based on input from the teams to summarize the section with a diagram of concepts addressed (introduce, adapt, and communicate).

The remaining open points will be further elaborated during the workshop based on input from the teams

- Variety of Information Domains

- Variety of Information collection methods

- Gaming internal management support

- Internal knowledge documentation

- Explaining value for reporting entities

- Data governance processes

- Multiple approaches to XBRL implementations in other countries

- Legacy reporting requirements

- Obsolete and duplicated data

- Changing legal requirements

- Analysis of software requirements

- Monitoring Implementation

- Review data collected

- Data processing performance

How to implement and extend XBRL taxonomies

One of the key challenges that regulators is facing when adopting XBRL standard is to fit the reporting requirements given by European frameworks and directives into the existing national supervisory and compliance processes.

In most of the cases the flexibility of the XBRL standard allows the national supervisor to fulfil both requirements, while the mechanisms to implement and extend taxonomies vary from one to another.

The objective of the present chapter is to provide a set of guidelines collected from previous national XBRL adoptions across Europe that have been harmonized in several ways.

The regulatory reporting's main objectives are to keep data accuracy, transparency, compliance and interoperability.

European Framework background information

The scope of this chapter will focus on European framework for regulatory reporting. Under this context, there are currently two major European Authorities that will drive the application of a harmonized reporting using XBRL. And therefore will address the corresponding recommendations in terms of implementation and extension of taxonomies for regulatory supervisors:

- EBA Taxonomy frameworks: COREP and FINREP

- EIOPA Taxonomy framework for Solvency II

National Supervisors in their adoption will use those taxonomies to their regulatory reporting according to the study on the national laws and application of the EU directives.

In terms of XBRL implementation those National adoption will represent the third namespace owner for reporting (covering the national GAAP):

XBRL Standard extension Mechanism:

XBRL standard mechanism to extension will be further elaborated during the workshop to introduce and use

- What is an extension [final definition will be further elaborated during workshop]. Purpose of extending European regulatory framework taxonomies -> the objective is to add more disclosure on base information (in some cases could be used also to restrict not applicable regulatory reporting information)

- namespaces [final definition will be further elaborated during workshop] owner of data defined and protected namespaces level 1 and level 2

- flexibility

- XBRL is extensible --> adaptation to national discretions

- Modularised architecture of XBRL

- Structural changes in the data are not reflected in the instance

- One common format is more cost-effective than a numerous number of different proprietary formats

- versioning

Guideline on Extensions:

[Extension recommendations will be further elaborated during workshop including a , list of best practice to follow based on the input of the teams.]

A taxonomy extending the European Framework should at least take into account a set of basic principles to facilitate efficient regulatory oversight, consistency of supervision and reduction of redundancies and duplications in their implementation:

- Simplicity of the reporting process: the resulting regulatory taxonomy architecture must focus on simplification of instance document creation.

- Stability: the application of the regulatory taxonomy architecture must minimize the impact of changes resulting from amendments of information requirements on consuming systems.

- Consistency: the framework under the regulatory taxonomy architecture must be consistent in design and the taxonomies must be coherent and explicit.

- Compliance with specifications, best practices and related taxonomies: the regulatory taxonomy architecture must conform as much as possible to approaches inherited from related projects (Level 1 and Level 2).

- Maintainability: the regulatory taxonomy architecture must allow for the framework be easy to maintain by supervisors.

- Performance: the application of the regulatory taxonomy architecture should result in other technical advantages including reduced size of instance documents, better performance in processing (e.g. DTS loading, validation),

- Reduction of redundancies and duplications

- Standardization, simplification

- Reduced information friction to facilitate (more) continuous monitoring and audit of controls

- Consistency of Regulatory Supervision

- Facilitate Efficient Regulatory Oversight

- keep the coherence and consistency of the model

Architecture, Methodology and Best Practices

This chapter links to CWA1.Use also references to documents drafted before and if not enough clear for roll-out package as a new supervisor, rewrite or add sample information to them.

Some reference document to analyze are:

- "An Architecture for European XBRL Taxonomies" where a description in the following topics is described:

- Supporting concepts(Owner, Model supporting schema, Namespaces)

- Public elements

- Dictionary of concepts (Metrics, Dimensions, Families, Perspectives, Domains, Explicit domain members and hierarchies)

- Reporting requirements layer (Frameworks, Taxonomies, Tables, Modules, Validation rules)

- Architecture

- "Data Point Modelling Methodology"

- "Abstract description of the model represented in taxonomies following the DPM approach"

- "Comparison of Conceptual, Logical and Physical models vs. the Data Point Modelling."

This chapter will introduce to regulators the current design techniques and implementation approach used in representing financial models defined by European Regulators. It is important to get familiar with terminology used in European XBRL Architecture, and Data Point Modelling Methodology, as these will be the base of best practice recommendations in terms of creating financial models based on European regulatory frameworks, as it is the perimeter of present document.

- XBRL Abstract Layer version 2.0

- Defines the reference to understand and better design in a separate and consistent form the financial and business models and rules that conforms the aspects, concepts, relationships and rules of the information to be modelled. Introduce an important decoupling vision for business reporting chain that enables design, architecture and implementation of XBRL.

- Data Point Model, also known as DPM Methodology

- Is a set of guidance methods, based on long track experience in supervisory reporting modelling, for the definition and identification of the data exchanged in reporting frameworks. It establish a robust and consistent method to represent and describe the data to be reported as the centre of definition, and all the semantics that belong to the data giving precision to its meaning

- XBRL Architecture

- Based on the dictionary of concepts modelled previously, it defines the set of technical definitions and rules that will enable the implementation of the model using XBRL standard language in the reporting systems. The architecture will be the guideline to ensure common practice across implementations to enable the interoperable, consistent and harmonized reporting. To achieve this goal the architecture will give enclose in a concrete structure using a set of definitions the possible open alternatives to implement the model, based on past XBRL implementation for European financial reporting frameworks versions, giving conventions in the way to implement the concrete frameworks.

Management and maintainability

This chapter should include all topics related to how the supervisor is facing the taxonomy frameworks usage, repository location and management, mirror and caching procedures to check different and current version and also extension visibility to make the harmonization of taxonomies transparent to other countries (if possible, at least as a recommendation on best practices). It will be further elaborated during workshop based on the input of the teams.

This would cover localization (in terms of how to physically locate), availability and download.

It should be worth noting the necessity to add a link or task to CWA2 in order to see the possibility to study the use of taxonomy package descriptor (from corefiling) as suggested by coordinator group management.

- transparency

- Comparability of data across Europe

- Possibility of a faster exchange of information with regard to the financial crisis

- Versioning will be supported

- Open source

- transparency

- validation

- Validation via standardised approaches

- Extensive possibilities for formula definitions

- Summarisation of formulas --> reduction of the amount of formulas

- No need for specific in-house solutions for the reporting entities

- validation

- harmonisation

- Approach is in line with the reconciliation for an harmonised reporting in the EU

- Uniform validation rules can be used

- Allows cooperation on a unified data basis (i.e. Colleagues of Supervisors)

- Enables an effective analysis of cross-border financial institutions

- harmonisation

- standardisation

- Assures competitive capacity

- Eases the exchange with other European countries

- Enables the use of standardised technology

- Eases interoperability

- Minimises risks

- No other standardised business reporting standard exists

- standardisation

How to transmit, process, and validate instances

This chapter will be further elaborated during workshop including the reference of conclusions from CWA2, and all topics related to how the supervisor is facing the taxonomy frameworks usage.

Bibliography

[1] xxx

[2] xxx